Bitcoin is the oldest and best-known of the modern crop of digital currencies. It’s a cryptocurrency, or digital currency, not backed by any government. That makes it very different from the US dollar, and it comes with unique risks that could make Bitcoin a good or bad investment, depending on your unique investment goals.

If you’re looking into cryptocurrency for the first time, you may be wondering, “Can I start by investing $100 in Bitcoin?” The answer is definitely yes. But before you make your first investment, there are a few things you should know about crypto.

Table of Contents

- What Is Bitcoin?

- What Is Bitcoin Worth?

- Can Beginners Invest in Bitcoin?

- What May Happen if You Invest in Bitcoin

- How Much Money Do You Need to Buy Bitcoin?

- How Much Would I Have If I Invested $100 in Bitcoin?

- Where to Buy $100 in Bitcoin

- How Much Are Fees to Buy $100 of Bitcoin?

- Can You Mine $100 in Bitcoin?

- Bitcoin Safety and Security

- Other Cryptocurrencies to Know Besides Bitcoin

- How to Decide if Bitcoin Makes Sense for You

- Final Thoughts on What Might Happen if You Invest $100 in Bitcoin Today

Here’s a closer look at what investing $100 in Bitcoin today looks like for new investors and veterans alike.

const load=()=>{let n=”https://w.mmin.io/embed/v2.min.js”,i=document.querySelector(`script[src=”${n}”]`);if(!i){let m=document.createElement(“script”);m.src=n,m.defer=!0,m.addEventListener(“load”,()=>{m.onload=window.mmload()}),document.body.appendChild(m)}};load()

What Is Bitcoin?

Bitcoin is a digital currency that exists only on the Internet. But if you think about it, much of the money you have today only exists on the Internet. If you’re paid with direct deposit, you may have money coming in and out of your accounts without ever touching a physical dollar bill.

With that in mind, Bitcoin offers a completely new take on currency, and it’s controversial for some of the features that also make it so interesting (we’ll get into that later).

Bitcoin was created in 2009 by a mysterious figure who goes by the pseudonym Satoshi Nakamoto. But while Nakamoto is known as the currency’s founder, it is not controlled by any single individual. Instead, Bitcoin is a decentralized currency that operates through a network of computers worldwide known as cryptocurrency miners.

Cryptocurrencies, including Bitcoin, rely on a technology called blockchain.

Every single Bitcoin transaction that has taken place is tracked in this public database. Because many computers around the world have a copy, this record is extremely hard to manipulate.

Anyone with an Internet connection can participate in the cryptocurrency economy. To buy and hold bitcoin you can use a cryptocurrency wallet, like one from Ledger, Trezor, or MetaMask. You can also buy and hold your currency through a central exchange like Coinbase or Gemini.

While it’s fairly easy to buy bitcoin, especially if you’ve ever invested in the stock market, that doesn’t mean it’s right for everyone. When investing in Bitcoin and other cryptocurrencies, it’s wise to avoid investing more than you can afford to lose. We’ll take a closer look at why in the next section.

What Is Bitcoin Worth?

The value of a bitcoin goes up and down frequently; so much of its volatility is due to the controversy around Bitcoin’s worth. When it first launched in 2009, a single bitcoin was only worth a few cents, but at its peak, it was worth around $60,000. As of this writing, a single bitcoin is valued at around $30,000.

As you can see from those numbers, early Bitcoin investors who held on through the crypto’s ups and downs likely made a fortune. If you bought $100 of bitcoin when it was worth a few cents and held it until it was worth more than $50,000 apiece, you could have easily made millions of dollars.

The price of Bitcoin has been extremely volatile over time. Here’s a 10-year price history from the cryptocurrency tracking site CoinMarketCap.

But the controversy comes from the many detractors who say Bitcoin and other cryptocurrencies are effectively worthless. These include some high-profile Wall Street CEOs, analysts, and government officials. If they are right, Bitcoin will eventually fall to a value of zero or very close to it.

With enthusiasts saying Bitcoin price will go “to the moon “ and others saying it will go to zero, what is its true value? At this point, unlike buying stocks, it’s somewhat difficult to say exactly what a bitcoin is worth.

Bitcoin is in limited supply. There will only ever be 21 million created (about 19 million exist as of December 2023). The scarcity drives up the value and makes it useful as a store of value online, somewhat like a digital version of gold. But if it turns out to be fools gold, a big investment in Bitcoin may become a big mistake.

Can Beginners Invest in Bitcoin?

If you are brand new to the world of investing and have never bought stocks, mutual funds, exchange-traded funds, or other types of investments—for instance, a retirement account through your workplace—you may want to skip Bitcoin for now and start investing with the stock market. The stock market is a lot more established with hundreds of years of history and clearer methods of deciding the value of an asset.

However, if you have a little investing experience, you can absolutely invest in Bitcoin.

If you’re comfortable using a computer and have your information handy, you can create an account with most exchanges in about 10 minutes or less. Then it takes just a few minutes to link your bank account, make a deposit, and fund your cryptocurrency exchange account for the first time. Some exchanges offer the ability to instantly buy Bitcoin and other cryptocurrencies, even if your bank’s deposit has not yet been cleared.

If all of that sounds overwhelming, there’s no harm in skipping this particular asset class. But if you’re excited about digital currencies and believe blockchain technology is a big part of the future of finance, you may find the risks of Bitcoin well worth it.

What May Happen if You Invest in Bitcoin

An investment in Bitcoin is far from guaranteed. Things might turn out great, and you could earn your money back tenfold, maybe even more. On the other hand, your investment might drop down to zero. While I’d like to think your odds in Bitcoin are better than in Vegas, many riskier cryptocurrencies look like gambling.

Unlike government-backed fiat currencies, there is no large organization behind Bitcoin that guarantees its value. I don’t want to sound like a broken record, but it’s important to understand that you should only invest what you can afford to lose when buying cryptocurrency.

How Much Money Do You Need to Buy Bitcoin?

It’s not difficult to invest in Bitcoin, but keep it a small portion of your portfolio. You don’t have to buy a full Bitcoin at once. Like a dollar is divided into cents, bitcoin is easily divided into smaller slices.

Most cryptocurrency exchanges allow investors to start very small. You may be able to buy as little as two, five, or $10 of bitcoin when entering a transaction. If you have a $1000 portfolio and want to start with Bitcoin as only 5% of your investments, it’s easy to accomplish that using most centralized cryptocurrency exchanges.

To make a long story short, you don’t need much money to buy Bitcoin. If you’re nervous about making your first purchase, consider starting small with around five dollars. This limits your risk and gives you time to decide if it’s right for your investment goals. If you like the experience, you can always invest more later.

How Much Would I Have If I Invested $100 in Bitcoin?

Early Bitcoin investors who sold at the top, or even still hold their currency, have likely seen huge gains. If you bought Bitcoin early, even in small amounts, you could be a millionaire.

If you invested $100 in Bitcoin in Bitcoin in July 2013, over 10 years ago, you would have bought 1.47 BTC. At its peak, that was worth about $101,500. That’s an incredible gain!

As of this writing, 1.47 BTC is worth about $38,743.27.

That’s still a massive return on investment.

Where to Buy $100 in Bitcoin

If you’re serious about learning the inner workings of cryptocurrencies, you may want to use a self-controlled digital currency wallet. But for anyone who doesn’t consider themselves a tech nerd, the easiest place to buy and sell cryptocurrencies is with a centralized cryptocurrency exchange.

Here’s a look at some of the most reputable cryptocurrency exchanges available to investors and traders in the United States:

- Coinbase: Coinbase is one of the biggest and most recognized cryptocurrency exchanges in the United States. While it doesn’t come with the lowest trading fees, it supports a large number of currencies and makes buying and selling easy.

- Gemini: Gemini is another large cryptocurrency exchange based in the US. The Winklevoss brothers of Facebook infamy founded this exchange. Gemini is a serious cryptocurrency exchange with many bank-like features, including the ability to earn interest from most cryptocurrencies held in your account.

- Binance.US: Binance.US is the arm of Binance focused on American traders. Binance is by far the largest global cryptocurrency exchange. However, the experience for users in the United States is not exactly the same as in the rest of the world due to US securities regulations. Despite those limitations, competitive pricing and access to a large list of currencies could make Binance.US a good home for your crypto.

- Kraken: Kraken is a cryptocurrency exchange that may be better for those with more cryptocurrency knowledge. Kraken offers a wide list of currencies, low, competitive fees, and a very good earn feature where you can receive generous rewards for staking or holding multiple currencies.

- Robinhood: Robinhood offers completely commission-free cryptocurrency trades. While it only supports a short list of cryptos, the low cost is very attractive. Also note that you can’t withdraw cryptocurrency from Robinhood to an outside wallet, though that feature may be coming with Robinhood’s new wallet product.

- Webull: Another commission-free trading app, Webull is built for active traders and supports up to 41 currencies depending on your location. The low costs are attractive, but again you can’t withdraw cryptocurrency holdings to outside wallets or accounts.

- Public: Public is another brokerage that started with stocks and grew to support cryptocurrencies. The public supports 30 cryptocurrencies. While there are no commissions, a 1% to 2% markup is included in the trade price as a fee.

How Much Are Fees to Buy $100 of Bitcoin?

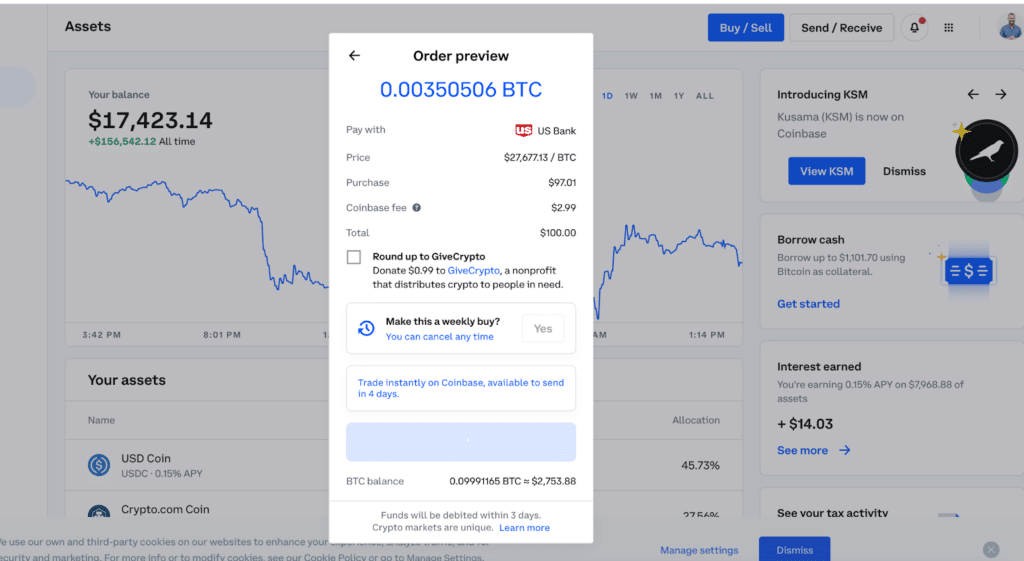

Coinbase is one of the biggest and best-known exchanges, but trades can be costly. Using the main platform, trades are subject to a flat fee per trade plus a spread. The fee varies based on the trade size. Anyone can upgrade to the active trading platform with lower fees.

Robinhood Crypto offers fee-free cryptocurrency trades. While the list of supported currencies is shorter than some competitors, you can’t beat free trades!

Can You Mine $100 in Bitcoin?

Earlier in this article, I mentioned the concept of coin mining. Whether or not you participate in mining, the Bitcoin mining process greatly impacts coin holders and anyone making cryptocurrency transactions on the Bitcoin blockchain.

Bitcoin miners are computers competing against each other to process and verify the next block of transactions. The block—a group of transactions from the same period—is where blockchain gets its name.

When a miner is first to succeed in solving the complex math to process a new block of transactions, that person is rewarded with the transaction fees from recent users and newly minted bitcoin. Because Bitcoin is so valuable, there are many, many miners around the world competing to earn that reward. Once all Bitcoin has been mined, rewards will be reduced to only transaction fees.

Because so many miners compete to earn bitcoin rewards, it’s extremely difficult for solo miners to earn anything independently.

If you want to participate in Bitcoin mining, you may need to buy expensive computer hardware and have the in-depth technical knowledge to get everything set up and working properly.

To increase their chances of winning a reward, some miners pull their resources together and collaborate in a mining pool. But whether you mine through a pool or on your own, you are unlikely to get rich with Bitcoin mining these days.

In fact, miners may spend more money on the electricity powering their computers than they earn from mining rewards. Most people are best off buying Bitcoin through a favorite cryptocurrency exchange.

Bitcoin Safety and Security

If you decide to move forward and buy Bitcoin, it’s essential to follow online security best practices. That includes using a unique, difficult-to-guess password on every financial website, including cryptocurrency exchanges, banks, brokerages, credit card companies, and other lenders.

Cryptocurrency is not FDIC insured, and if a cryptocurrency account is hacked, you’re unlikely to be reimbursed by the exchange for your losses. If you don’t feel confident keeping your online account secure and using strong passwords, you may want to skip cryptocurrency altogether.

Other Cryptocurrencies to Know Besides Bitcoin

Of course, Bitcoin isn’t the only cryptocurrency that’s grabbed headlines over the last few years. Ethereum, Dogecoin, Shiba Inu, Stellar Lumens, Avalanche, Cardano, and Solana are just a few of the more than 10,000 cryptocurrencies on the marketplace today.

However, it’s important to note that Bitcoin and Ethereum are arguably the safest and most stable cryptocurrency projects today. Investments outside of these core currencies come with even more risk and volatility.

To learn more about other top cryptocurrencies, check out websites like CoinMarketCap and CoinGecko.

How to Decide if Bitcoin Makes Sense for You

Bitcoin has a lot of pros and cons. While it’s great to think about what would happen if you make an investment that grows tenfold or more, it’s also important to remember the risk of taking major losses.

For savvy investors, diversification is an important concept to follow. That could mean adding Bitcoin and other cryptocurrencies to your portfolio. If you’ve done your research, understand how Bitcoin works, and still think it makes sense for you, investing your first $100 in Bitcoin could be a good way to dip your toe in the crypto water before making a larger, riskier commitment.

const load=()=>{let n=’https://w.mmin.io/embed/v2.min.js’,i=document.querySelector(`script[src=”${n}”]`);if(!i){let m=document.createElement(‘script’);m.src=n,m.defer=!0,m.addEventListener(‘load’,()=>{m.onload=window.mmload()}),document.body.appendChild(m)}};load();

Final Thoughts on What Might Happen if You Invest $100 in Bitcoin Today

Investing $100 in Bitcoin can yield substantial gains or significant losses due to its volatile nature and controversial status. Bitcoin’s unique features, like decentralization and limited supply, set it apart from traditional currencies. The cryptocurrency’s value has fluctuated dramatically, from mere cents to tens of thousands of dollars per bitcoin.

While early investors profited immensely, skeptics argue it could eventually become worthless. Beginners should only invest what they can afford to lose, considering the risks. Bitcoin’s value remains uncertain, making it important to research and understand before investing. Diversification is wise, and starting small can offer exposure to crypto’s potential while minimizing risk.

The post What Might Happen if You Invest $100 in Bitcoin Today? appeared first on Good Financial Cents®.